Shareholder structure and proposed acquisition by EssilorLuxottica.2015 Initial Public Offering and listing.2020 Remuneration for the Supervisory Board.Conditional deviations from the Remuneration Policy 2019.Remuneration for the Management Board in 2020.Proposed transaction of EssilorLuxottica.Remuneration Policy 2019 & Long-term Incentive Plan 2015.Information referred to in Section 1 of Takeover Directive (Article 10) Decree.

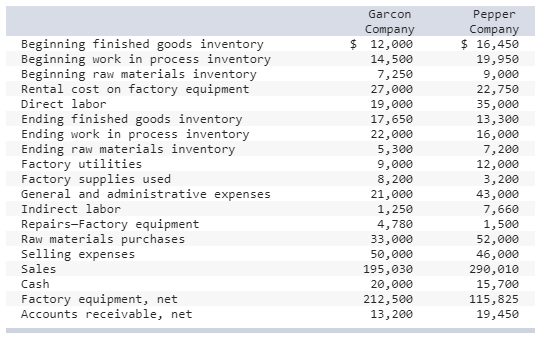

COGS BALANCE SHEET CODE

Compliance with the Dutch Corporate Governance Code.

2020 Financial Statements and dividends.Composition of the Supervisory Board and Management Board.Giving back to our communities and reducing environmental impact.Accelerate omnichannel and digitally empower customer experiences.Manufacturing and dedicated production lines.Ensuring safe and high-quality products.Strategic sourcing and product procurement.Our inclusive, diverse and ethical work environment.How we attract, develop and retain talent.Creating and managing a global workforce.Align our impact with UN Sustainable Development Goals.How we create long-term value for our stakeholders.It's important to understand the difference between these two concepts in order to properly manage your business finances. COGS is the direct costs associated with the production of the goods that were sold during a period. Inventory is the raw materials, work-in-progress, and finished goods that a company has on hand. However, there is a big difference between the two concepts. In business, the terms "inventory" and "cost of goods sold" are often used interchangeably. As you can see, the cost of goods sold includes the cost of the inventory that was sold, as well as the direct costs associated with the production of those goods. The total cost of goods sold for Company XYZ is $100,000. The direct costs associated with the production of those goods were as follows: Now, let's assume that Company XYZ sold $100,000 worth of goods during the year. The total value of Company XYZ's inventory is $60,000. Assume that Company XYZ has the following inventory on hand at the end of the year:

To further illustrate the difference between inventory and COGS, let's take a look at an example. COGS is an expense that is deducted from revenue to arrive at net income.

0 kommentar(er)

0 kommentar(er)